UNITED STATES

☐

| ☐ | Preliminary Proxy Statement | ||||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||

| ☒ | Definitive Proxy Statement | |||||

| Definitive Additional Materials | ||||||

| Soliciting Material | ||||||

(Name of Registrant as Specified In Its Charter) None (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table | |||||||||||||

Largest intermodal container leasing and sales company in the world | 7.3 million twenty-foot equivalent units (“TEU”) of containers | |||||||

Leased containers from 151locations in 43different countries in 2021 | Sold containers from 293locations in 81different countries in 2021 | |||||||

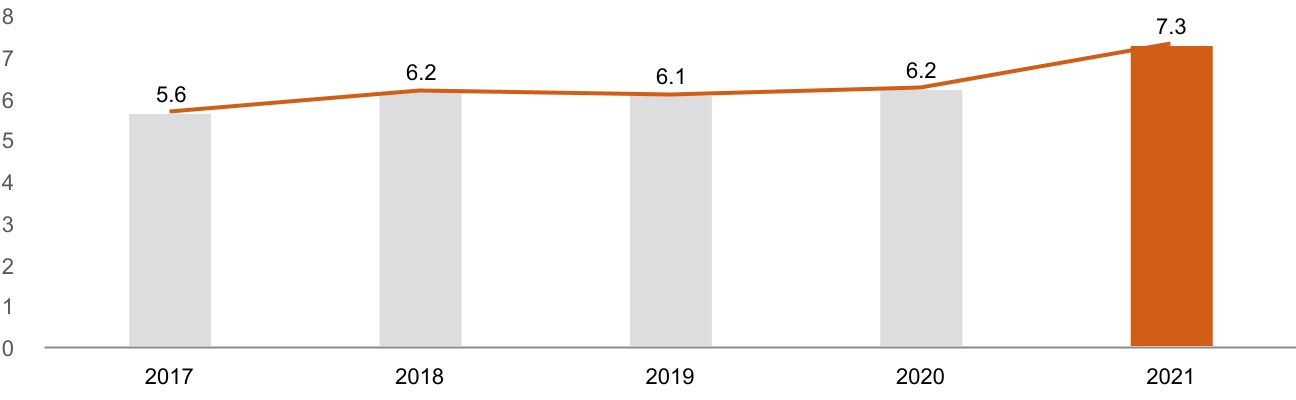

| STEADY FLEET GROWTH (TEU in millions) | ||

We conduct business the “right way,” keeping our customers’ and colleagues’ interests at the center of everything we do. We are transparent with our stakeholders and support the communities in which we operate. | Our talented network of | |||||||||||||

Creativity We structure transactions with customers by finding that “win-win” sweet spot that works best for them and us. We foster entrepreneurship, and we respect it in our customers. Our approach enables us to be responsive, decisive, and pivot quickly in an ever-changing world. | Long-term view We strive for success over the long term. We take a disciplined approach to running our business and invest in our people, our equipment, and our customer relationships to create a Triton that is built to last. | |||||||||||||

Reliability We provide efficiency and certainty in a variable world. Our scale and operational experience allow our customers to count on our promise to supply high-quality containers wherever and whenever they’re needed. We strive to exceed the highest expectations. | Teamwork | |||||||||||||

an opportunity to work together to achieve common business goals. | ||||||||||||||

TRITON INTERNATIONAL LIMITED

CANON’S COURT22 VICTORIA STREETHAMILTON HM12, BERMUDA

April 4, 2018

Dear Shareholders,

You are cordially invited to join us for our Annual General Meeting of Shareholders (the “Annual Meeting”) to be held this year on May 2, 2018, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601 USA.

The Notice of Annual General Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the Annual Meeting. You will be asked to: (i) elect nine directors to the Board of Directors; (ii) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; (iii) approve on an advisory basis the compensation of our Named Executive Officers; and (iv) act on any other matters as may properly come before the shareholders at the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary.

Whether or not you intend to be present at the Annual Meeting, it is important that your shares be represented. Voting instructions are provided in the accompanying proxy card and Proxy Statement. Please vote via the Internet, by telephone, or by completing, signing, dating and returning your proxy card.

TRITON INTERNATIONAL LIMITED

Canon’s Court22 Victoria StreetHamilton HM12, Bermuda

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERSto be held on May 2, 2018

To Our Shareholders:

The Board of Directors of Triton International Limited hereby gives notice that the Annual General Meeting of Shareholders (the “Annual Meeting”) of Triton International Limited will be held on May 2, 2018, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601 USA. The purpose of the Annual Meeting is to:

| Notice of |  | ||||

DATE AND TIME April 26, 2022, at 12:00 p.m., Eastern Daylight Time. | PLACE Virtual Shareholder Meeting at www.virtualshareholdermeeting.com/TRTN2022 | RECORD DATE Close of March 1, 2022. | ||||||

VOTING Shareholders as of the record date are entitled to vote. Each common share is entitled to one vote | ADMISSION You will need the 16-digit control number included in your proxy materials to participate in the virtual meeting webcast. | |||||||

| Items to be Voted on | ||||||||

PROPOSAL 1 Election of The Board recommends you vote FOReach nominee | PROPOSAL 2 Advisory Vote to Approve the Compensation of Named Executive The Board recommends you vote FOR this proposal | PROPOSAL 3 Appointment of Independent Auditors and Authorization of Remuneration The Board recommends you voteFOR this proposal | ||||||

YOUR VOTE IS IMPORTANT Even if you plan to attend the Annual Meeting | ||||||||||||||

VIA THE INTERNET IN ADVANCE visiting www.proxyvote.com | WITH YOUR MOBILE DEVICE Scan the QR code on your notice of internet availability of proxy materials, proxy card or voting instruction form | BY MAIL mailing your signed proxy card or voting instruction form | BY TELEPHONE calling toll-free from the United States, U.S. territories and Canada to | |||||||||||

We

The Board of Directors has fixed the close of business on March 9, 2018 as the record date for the determination of shareholders entitled to notice of andable to vote atyour shares electronically during the Annual Meeting or any adjournment or postponement thereof.

You are cordially invitedmeeting. Details about how to attend the Annual Meeting in person. If you attendonline and how to submit questions and cast your votes are provided under “Information About the Annual Meeting you may vote in person if you wish, even though you may have previously voted your proxy. and Voting” beginning on page 62.

April 4, 2018

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE PROMPTLY VOTE VIA THE INTERNET, BY TELEPHONE, OR COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD FOR THE ANNUAL MEETING AND RETURN IT AS INSTRUCTED ON THE PROXY CARD. THIS WILL ENSURE REPRESENTATION OF YOUR SHARES AT THE MEETING.

Internet Availability of Proxy Materials

The Proxy Statement and the 2017 Annual Report are available on www.proxyvote.com.

TRITON INTERNATIONAL LIMITED

Canon’s Court22 Victoria StreetHamilton HM12, Bermuda

PROXY STATEMENTFOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERSto be held on May 2, 2018

INFORMATION ABOUT VOTING

General

This Proxy Statement and the accompanying Notice of Annual General Meeting of Shareholders are being furnished in connection with the solicitation by the Board of Directors of Triton International Limited (“Triton,” the “Company,” “us,” “our” or “we”) of proxies for use at the Annual General Meeting of Shareholders (the “Annual Meeting”) to be held on May 2, 2018, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601, and at any adjournment or postponement thereof, for the purposes set forth in the preceding Notice of Annual General Meeting of Shareholders. This Proxy Statement and the proxy card for the Annual Meeting are first being made available or distributed to shareholders of record on or about March 16, 2022.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON APRIL 26, 2022: Triton's Proxy Statement and 2021 Annual Report are available at www.proxyvote.com. | ||

The cost of soliciting proxies26, 2022 at 12:00 p.m. Eastern Daylight Time. To provide a safe and widely accessible experience for our shareholders, the Annual Meeting will be borneheld online via live webcast. You can attend the Annual Meeting, vote your shares and submit questions electronically during the virtual meeting by visiting

| Triton International achieved an extraordinary year in 2021. Like everyone, Triton faced significant challenges and uncertainty due to the ongoing pandemic. The market we serve, global containerized trade, was highly impacted by disruptions to transportation productivity and further strained by changes in consumer spending patterns, which created a surge in demand for goods. Triton responded to these unprecedented challenges by providing critically needed support for our customers. We supplied large numbers of containers to virtually every major shipping line in the world, and we invested heavily in our container fleet to maintain our deep stand-by supply capacity. | |||||

“Triton’s strong performance in 2021 reflects the strength of our business model and our leadership position in the container leasing industry.” | |||||

| 4 | TRITON | ||||

| “Our Board is deeply engaged, with a focus on key levers that drive long-term value creation, including major investment decisions, capital management, long-term business strategy, talent development and leadership succession planning.” | Triton’s Board also works with our management team to ensure Triton remains a good corporate citizen. We believe global trade is a positive force for the world, increasing global economic growth and expanding prosperity and opportunity. Our role in making global trade more efficient and resilient to shocks like the pandemic supports this power of trade. We are also focused on making a positive impact on our business of container leasing, and in particular, we continue to work closely with our container manufacturing suppliers to reduce the environmental impact of container production. We work hard to provide our global team with an inclusive, respectful and rewarding work environment and seek to support the communities where we operate. | ||||

|  | |||||||

|  | |||||||

Brian M. Sondey Chairman and Chief Executive Officer | Robert L. Rosner Lead Independent Director | |||||||

| 2022 Proxy Statement | 5 | ||||

2021 Social Highlights | |||||

| 6 | TRITON | ||||

PROPOSAL 1 Election of Directors | PROPOSAL 2 Advisory Vote to Approve The Compensation of Named Executive Officers | PROPOSAL 3 Appointment of Independent Auditors and Authorization of Remuneration | |||||||||||||||

FOR each nominee See page 14for more details | |||||||||||||||||

FOR this proposal See page 37 for more details | FOR this proposal See page 58 for more details | ||||||||||||||||

| Nominee and Principal Occupation | Age | Director Since | Independent | Audit Committee | Compensation and Talent Management Committee | Nominating and Corporate Governance Committee | |||||||||||||||||

| Brian M. Sondey - Chairman Chief Executive Officer, Triton International Limited | 54 | 2016 | ||||||||||||||||||||

| Robert W. Alspaugh Former Chief Executive Officer, KPMG International | 75 | 2016 |  | |||||||||||||||||||

| Malcolm P. Baker Robert G. Kirby Professor, Harvard Business School | 52 | 2016 |  | |||||||||||||||||||

| Annabelle Bexiga Former Chief Information Officer, Commercial Insurance, AIG | 60 | 2020 |  | |||||||||||||||||||

| Claude Germain Principal and Managing Partner, Rouge River Capital | 55 | 2016 |  | |||||||||||||||||||

| Kenneth Hanau Managing Director, Bain Capital | 56 | 2016 |  | |||||||||||||||||||

| John S. Hextall Former CEO, Kuehne & Nagel North America | 65 | 2016 |  | |||||||||||||||||||

| Niharika Ramdev Former Chief Financial Officer, Global Cadillac, General Motors | 52 | 2021 |  | |||||||||||||||||||

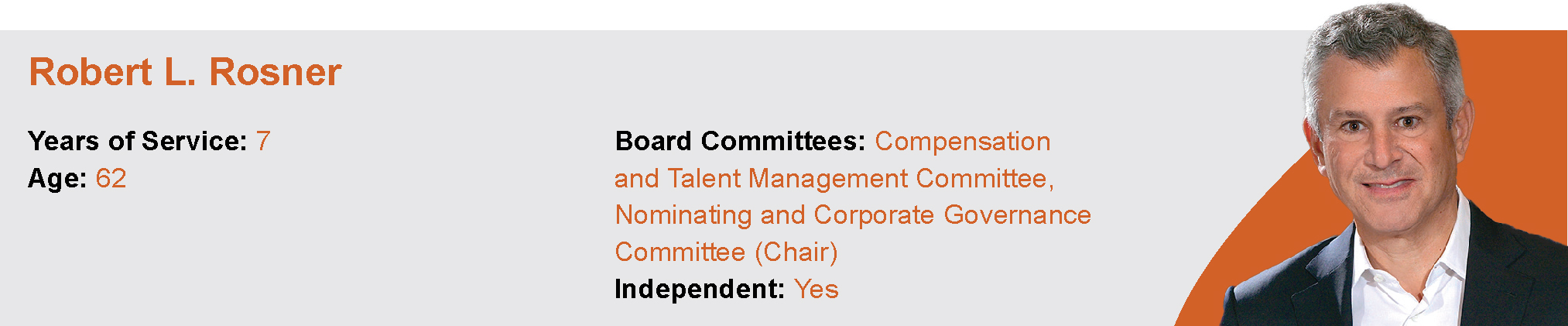

| Robert L. Rosner - Lead Independent Director Co-President, Vestar Capital Partners | 62 | 2015 |  | |||||||||||||||||||

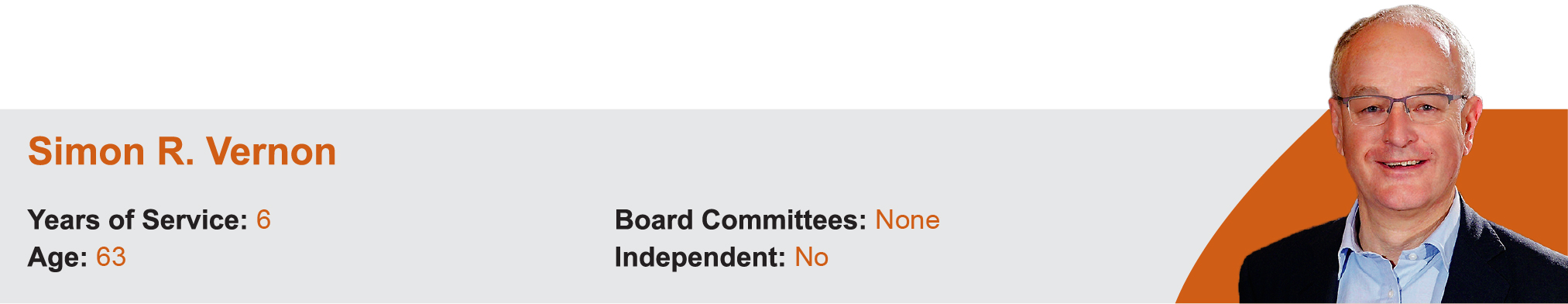

| Simon R. Vernon Former President, Triton International Limited | 63 | 2016 | ||||||||||||||||||||

| Chair | |||||

| Member | |||||

| 2022 Proxy Statement | 7 | ||||

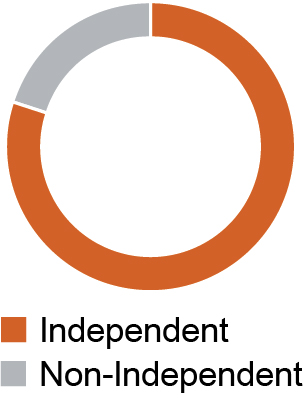

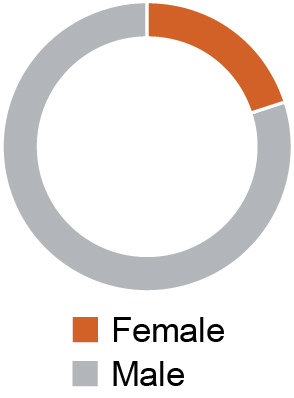

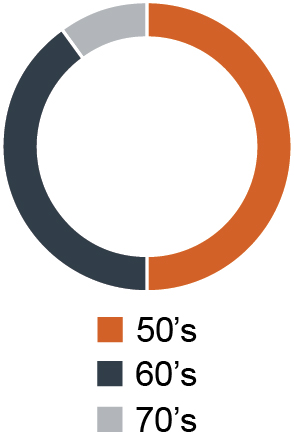

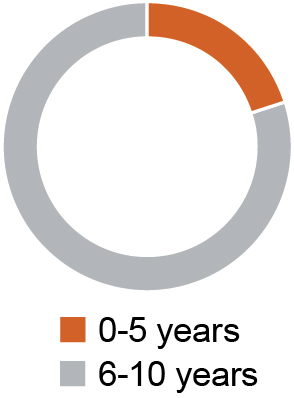

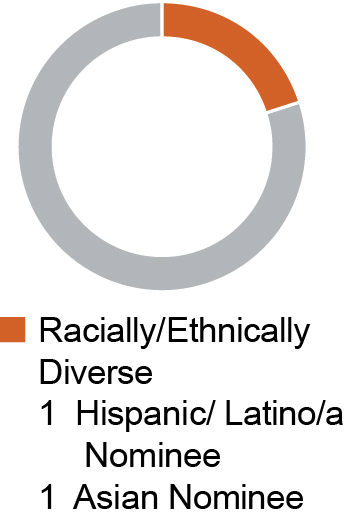

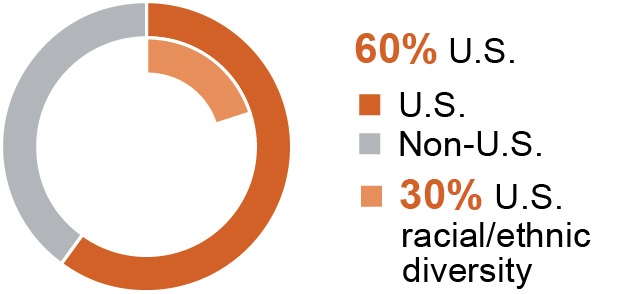

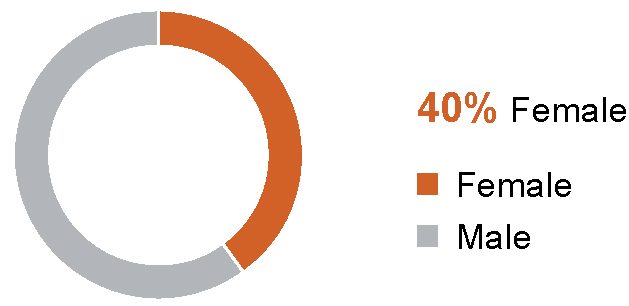

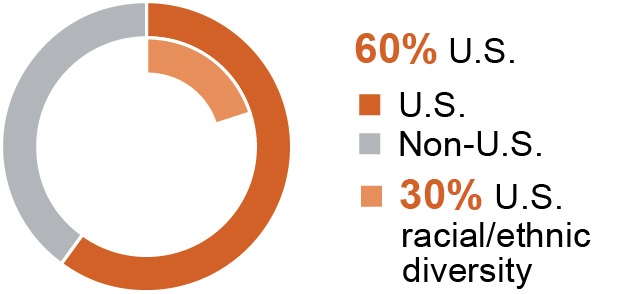

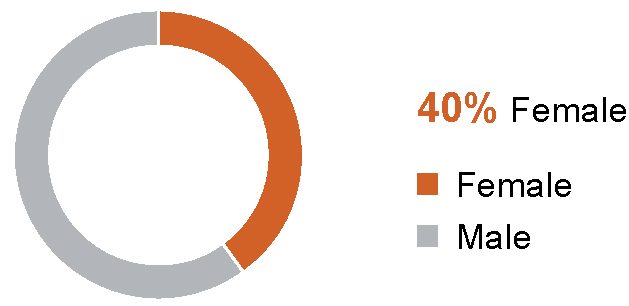

80% Independent | 20% Female | 59.4 years Average Age | 5.2 years Average Tenure | 20% Racially/Ethnically Diverse | ||||||||||

|  |  |  |  | ||||||||||

| EXECUTIVE LEADERSHIP EXPERIENCE | |||||

| CONTAINER LEASING/LOGISTICS/ TRANSPORTATION/SUPPLY CHAIN | |||||

| INTERNATIONAL EXPERIENCE | |||||

| FINANCE/CAPITAL ALLOCATION | ||||

| RISK MANAGEMENT | |||||

| STRATEGIC PLANNING/M&A | |||||

| CORPORATE GOVERNANCE/OTHER PUBLIC COMPANY BOARD | |||||

| 8 | TRITON | ||||

| Triton has a long-standing commitment to strong corporate governance, which promotes the long-term interests of shareholders and strengthens Board and management accountability. Highlights of our corporate governance practices include: | ISS QualityScore | |||||||||||||

| 1 | ||||||||||||||

GOVERNANCE Highest Rating By | ||||||||||||||

| INSTITUTIONAL SHAREHOLDER SERVICES | ||||||||||||||

SHAREHOLDER RIGHTS | BOARD OVERSIGHT | BOARD COMPOSITION AND INDEPENDENCE | |||||||||||||||||||||||||||

•Annual Election of Directors •Majority Voting for Directors •No Poison Pill •Right to Call Special Meeting •One Class of Common Shares With Each Share Entitled to One Vote | •Active Strategy and Risk Oversight by Full Board and Committees, including: •Business and Market Risks •COVID-19 Response •ESG Initiatives •Human Capital Management •Robust Shareholder Engagement | •Lead Independent Director •80% Independent Board and Fully Independent Board Committees •Board Commitment to Recruiting Qualified, Diverse Director Candidates •12-Year Term Limit for Non-Management Directors | |||||||||||||||||||||||||||

EXECUTIVE COMPENSATION AND SHAREHOLDER ALIGNMENT | OTHER GOVERNANCE PRACTICES | ||||||||||||||||||||||||||||

•Annual “Say on Pay” Advisory Vote •Annual benchmarking of executive compensation and Company performance against relevant peer group •Anti-Hedging/Anti-Pledging Policies for Directors, Officers and Employees •Clawback Policy for Equity Awards and Annual Incentive Compensation •Meaningful Share Ownership Requirements for Executive Officers and Directors | •Active Board Role in CEO and Management Succession Planning •Regular Executive Sessions of Non-management and Independent Directors •Director Overboarding Limits •Annual Board and Committee Self-Assessments | ||||||||||||||||||||||||||||

Recent Governance Changes We regularly review our governance policies and practices and incorporate valuable feedback from our shareholders in our decision making processes to ensure that our practices remain aligned with the high standards we set for ourselves across our operations. Recent governance changes include: •Focus on Board Diversity – 20% of our Board is diverse and our Board’s commitment to continuing to enhance Board diversity is ongoing •Enhanced Share Ownership Guidelines – In 2021, we increased the share ownership guideline for non-employee directors to further align the interests of our directors with those of shareholders •ESG/Sustainability – we amended the Nominating and Corporate Governance Committee charter to add ESG oversight duties to its responsibilities •Human Capital – we amended the Compensation and Talent Management Committee charter to add oversight of human capital management activities, including talent management and development, Company culture and diversity and inclusion to its responsibilities | |||||

| 2022 Proxy Statement | 9 | ||||

COMPANY CULTURE | HUMAN CAPITAL GOVERNANCE | TOTAL REWARDS | HEALTH AND WELLNESS | LEARNING AND DEVELOPMENT | ||||||||||

| OUR GLOBAL AND DIVERSE WORKFORCE | GENDER DIVERSITY (Global) | |||||||||||||

|  | |||||||||||||

| 10 | TRITON | ||||

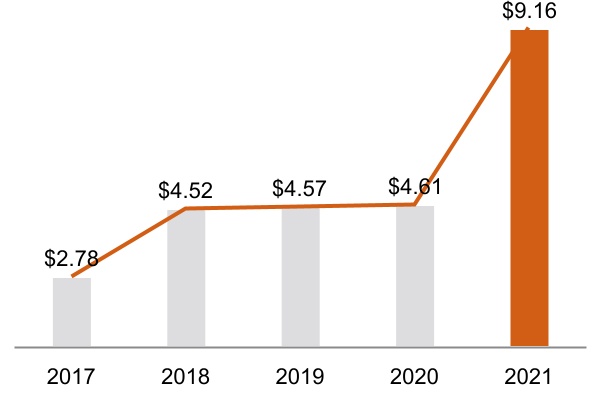

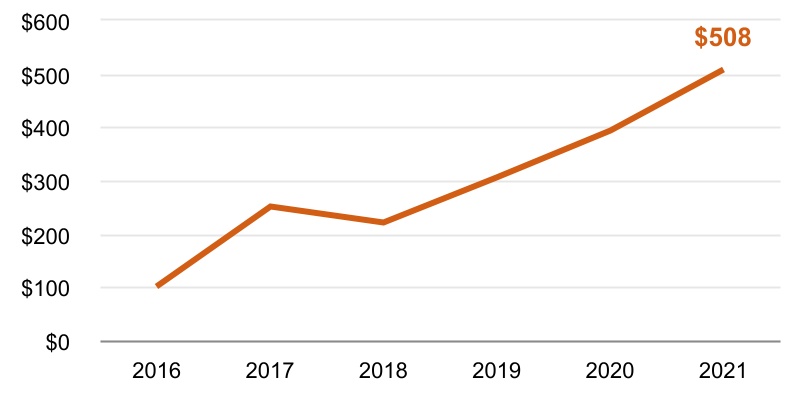

| EARNINGS PER SHARE | YEAR END UTILIZATION | ADJUSTED RETURN ON EQUITY* | ||||||||||||

$7.22 GAAP $9.16 Adjusted* | 99.6% | 28.1% | ||||||||||||

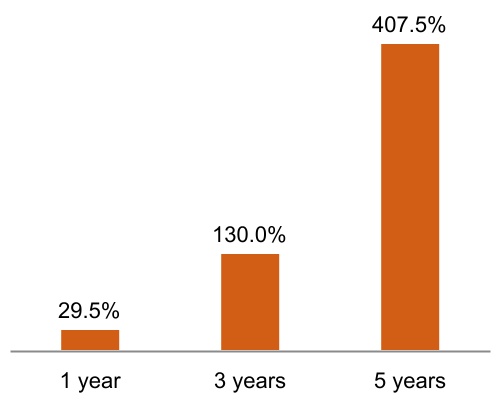

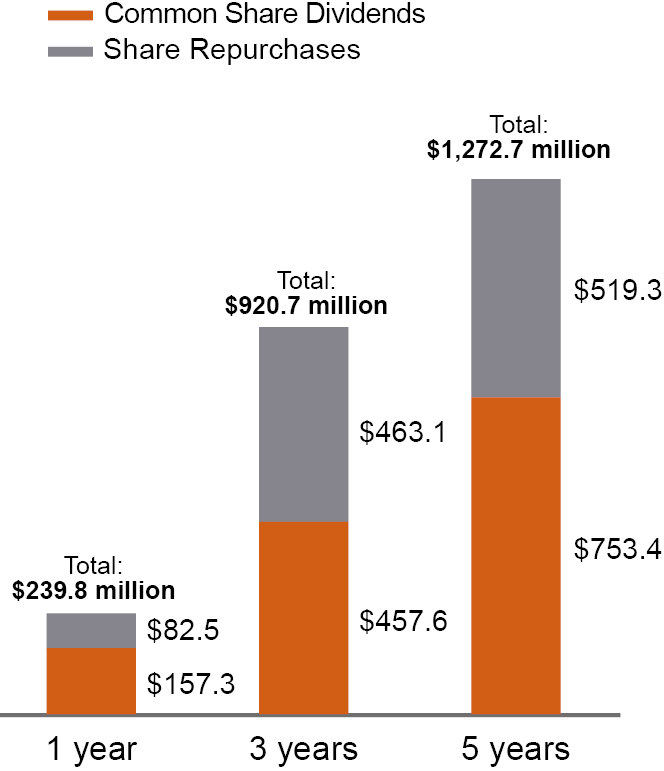

TOTAL SHAREHOLDER RETURN | COMMON SHARE DIVIDENDS | CASH RETURNED TO SHAREHOLDERS | ||||||||||||

| 29.5% | ~14% Increase | $239.8 Million Returned Through Common Share Dividends and Share Repurchases | ||||||||||||

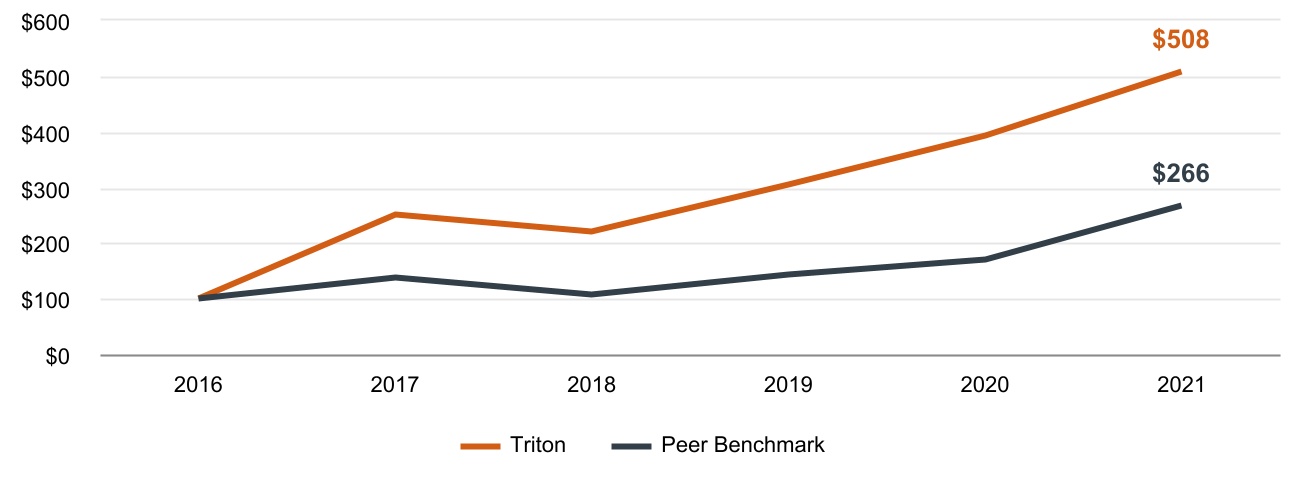

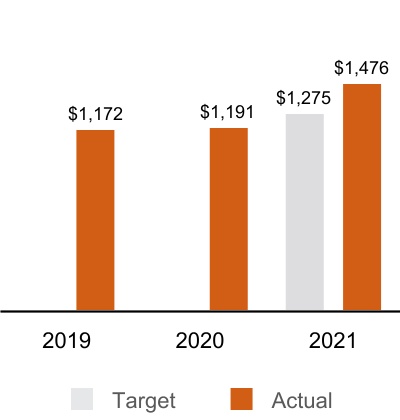

| 5-YEAR ADJUSTED EARNINGS PER SHARE | ||

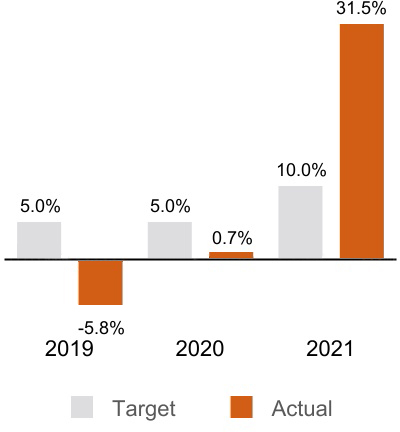

| 5-YEAR ADJUSTED RETURN ON EQUITY | ||

| 5-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN** | ||

Who can vote?

Only holders of recordAdjusted return on equity and Cash flow before capital expenditures as of the close of business March 9, 2018 (the “Record Date”) of the Common Shares are entitled to vote at the Annual Meeting. On the Record Date, there were 80,815,752 Common Shares outstanding.

What proposals will be voted on at the Annual Meeting?

Shareholders will vote on the following proposals at the Annual Meeting:

In addition, in accordance with Section 84 of the Companies Act and Section 39 of our Bye-Laws, our audited financial statements for the fiscal year ended December 31, 2017 will be presented at the Annual Meeting. These audited financial statements are included in our Annual Report on Form 10-K for the year ended December 31, 2017 (the “2017 Annual Report”). There is no requirement under Bermuda law that these financial statements be approved by shareholders, and no such approval will be sought at the Annual Meeting.

How does our Board of Directors recommend that I vote on the proposals?

1

| 2022 Proxy Statement | 11 | ||||

| Significant Asset Growth, Leading Market Share of Leasing Transactions and Extended Lease Durations | ||

| We invested over $3.6 billion in new equipment in 2021, which drove an asset growth rate of over 30%. We led the | ||

| Lower Interest Costs and Investment Grade Credit Ratings | ||

| We refinanced $3.8 billion of long-term debt in 2021 to support the rapid growth of our container fleet and reduce our financing costs. Over the course of the | ||

Triton has a history of strong say-on-pay results. In 2021, approximately 96% of the votes cast on our say-on-pay proposal were cast in support of the 2020 compensation of our Named Executive The Compensation and Talent Management Committee of our Board regularly reviews and refines our executive compensation program to ensure it remains competitive, supports strategic objectives, appropriately aligns executive and shareholder interests and rewards performance. As part of this review, the Committee has made changes to our annual incentive and equity incentive programs for 2022 as described later in this |  ~98% | ||||

| Five-Year Average Shareholder Support of Say-on-Pay Proposal | |||||

If any

| 12 | TRITON | ||||

How many votes can I cast?

You will be entitled to one vote per Common Share owned by you on the Record Date.

How do I vote by proxy?

Vote by Internet

The proxy card or voting instruction card contains instructions on how to view our proxy materials on the Internet, vote your shares on the Internet, and request electronic delivery of future proxy materials. An electronic copy of this Proxy Statement and the 2017 Annual Report are available at www.proxyvote.com. You may use the Internet to transmit your voting instructions until 11:59 p.m., Eastern Time, on May 1, 2018. You should have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Shareholders may request receipt of future proxy materials by email, which will save us the cost of printing and mailing documents to those shareholders. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Vote by Telephone 1-800-690-6903

Call 1-800-690-6903 from any touch-tone telephone and follow the instructions. Have your proxy card available when you call and use the Company Number and Account Number shown on your proxy card. The submission of your proxy by telephone is available 24 hours a day. To be valid, a submission by telephone must be received by 11:59 p.m., Eastern Time, on May 1, 2018.

Vote by Mail

Follow the instructions on the enclosed proxy card for the Annual Meeting to vote on the proposals to be considered at the Annual Meeting. Sign and date the proxy card and return it as instructed on the proxy card.

The proxy holders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on the proposals, the proxy holders will vote for you on the proposals.

Unless you instruct otherwise, the proxy holders will vote “FOR” the nominees proposed by our Board of Directors, “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018, and “FOR” the approval of the compensation of our Named Executive Officers as described in this Proxy Statement.

What if other matters come up at(“NEOs”) was allocated among base salary, annual cash incentive awards, time-based restricted shares and performance-based restricted shares, summarizes the Annual Meeting?

The matters described in this Proxy Statement arepurpose and performance period for each pay element and lists the only matters we know will be voted on at the Annual Meeting. If other matters are properly presented at the Annual Meeting or any adjournment or postponement thereof, the proxy holders will vote your shares as they see fit at their discretion.

What can I do if I change my mind after I vote my shares?

At any time before the vote at the Annual Meeting, you can revoke your proxy either by (i) giving our Secretary a written notice revoking your proxy, (ii) voting again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), (iii) signing, dating and returning to our Secretary a new proxy card bearing a later date or (iv) attending the Annual Meeting and voting in person. Your presence at the Annual Meeting will not revoke your proxy unless you vote in person. All written notices or new proxies should be sent to Secretary, Triton International Limited c/o Estera Services (Bermuda) Limited at Canon's Court, 22 Victoria Street, Hamilton HM12 Bermuda.

2

Can I vote in person at the Annual Meeting rather than by completing the proxy card?

Although we encourage you to vote via the Internet, by telephone, or by completing and returning the proxy card to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares in person.

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

What are broker non-votes?

Broker non-votes are shares held in street name by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote those shares as to a particular matter. Under the rules of the New York Stock Exchange, your broker or nominee does not have discretion to vote your shares on non-routine matters such as Proposal 1 (election of directors) and Proposal 3 (advisory vote on the compensation of Named Executive Officers). However, your broker or nominee does have discretion to vote your shares on routine matters such as Proposal 2 (ratification of the appointment of KPMG LLP as our independent registered public accounting firmperformance metrics for the fiscal year ending December 31, 2018). Broker non-votes are not counted for purposes of determining whether a proposal has been approved.

What is a quorum?

We will hold the Annual Meeting if a quorum is present. A quorum will be present if the holders of a majority of the Common Shares entitled to vote on the Record Date are present in person or by proxy at the Annual Meeting. Without a quorum, we cannot hold the meeting or transact business. If you vote via the Internet, by telephone, or signannual and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on the proposals listed on the proxy card. Abstentions and broker non-votes will also be counted as present for purposes of determining if a quorum exists.

What vote is necessary for action?

Passage of Proposal 1 (election of directors) requires, for each director, the affirmative vote of a majority of the votes cast. You will not be able to cumulate your votes in the election of directors. Approval of Proposal 2 (ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018) will require the affirmative vote of the holders of a majority of the votes cast. Approval of Proposal 3 (advisory vote on the compensation of Named Executive Officers) will require the affirmative vote of a majority of the votes cast, although such vote will not be binding on us. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present; however, in tabulating the voting results for any particular proposal abstentions and broker non-votes will have no effect on the outcome of the matter.

Who pays for the proxy solicitation?

We will bear the expense of soliciting proxies for the Annual Meeting, including the costs of distributing proxy materials to our shareholders. In addition to solicitation by mail, directors, officers and other employees also may solicit proxies personally, by telephone or through electronic communications, but will not receive specific compensation for doing so. We may reimburse brokerage firms and others holding shares in their names or in names of nominees for their reasonable out-of-pocket expenses in sending proxy materials to beneficial owners.

PRESENTATION OF FINANCIAL STATEMENTS

In accordance with Section 84 of the Companies Act and Section 39 of the Bye-Laws, our audited financial statements for the fiscal year ended December 31, 2017 will be presented at the Annual Meeting. These financial statements are included in our 2017 Annual Report. There is no requirement under Bermuda law that these financial statements be approved by shareholders, and no such approval will be sought at the meeting.

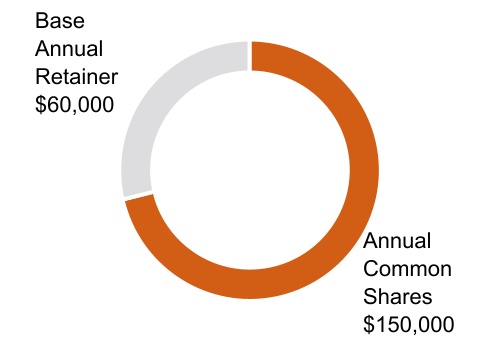

| Pay Element | Purpose | Performance Period | Performance Metrics/Link | ||||||||||||||||||||

| CEO | Other NEOs | ||||||||||||||||||||||

| Fixed | |||||||||||||||||||||||

| Base salary |  22% |  39% | •Attract and retain talent | Annual | •Subject to annual adjustment based on market data, job responsibilities and individual performance | ||||||||||||||||||

| Performance-based/At-risk |  78% |  61% | |||||||||||||||||||||

| Annual cash incentive |  22% |  23% | •Incentivize achievement of annual financial and operational/ strategic objectives | Annual | •Adjusted EPS •Cash Flow Before Capital Expenditures [NEW] •Growth in Revenue Earning Assets | |||||||||||||||||

| Time-based restricted shares |  28% |  19% | •Facilitate stock ownership •Promote executive retention •Align shareholder and management interests | Three-Year Cliff Vest | •Stock price appreciation | |||||||||||||||||

| Performance-based restricted shares |  28% |  19% | •Reward long-term performance, including relative to peers •Promote executive retention •Align management and shareholder interests | Three-Year Cliff Vest | •Relative total shareholder return (‘‘TSR’’) •Adjusted Return on Equity [NEW] | ||||||||||||||||||

3

| 2022 Proxy Statement | 13 | ||||

PROPOSAL 1 | Election of Directors | ||||||||||

The Board recommends a vote “FOR” the election of the nominees listed on the following pages to the Board of Directors. | |||||||||||

PROPOSAL 1ELECTION OF DIRECTORS

AtThe Board is currently comprised of 10 highly-qualified individuals with a diverse and complementary range of skills and experience that provide the Annual Meeting, the shareholders will elect nineBoard and management with valuable insights and enable effective oversight of our business, strategic direction and performance. All of our current directors are standing for re-election for a term of one year, to serve until the 2019 Annual Meeting2023 annual general meeting of shareholders or until their respective successors are elected and qualified. In the absence of instructions to the contrary, a properly signed and dated proxy will vote the shares represented by that proxy “FOR” the election of the nine nominees named below.

| ||

| 14 | TRITON | ||||

| Board Changes in Last 2 Years | Diversity of newly added Directors | Skills of newly added Directors | |||||||||

2 new independent directors have been added to the Board | Global Supply Chain | ||||||||||

1 director has left the Board | Audit Financial Expertise | ||||||||||

| IT and Cybersecurity | |||||||||||

| |||||

Brian M. Sondey | is our Chairman and Chief Executive Officer, and | has served as a director since July 2016. Upon the closing of the merger of Triton Container International Limited (“TCIL”) and TAL International Group, Inc. (“TAL”) in July 2016, Mr. Sondey, who had served as the Chairman, President and Chief Executive Officer of TAL since 2004, became the Chairman and Chief Executive Officer of Triton. Mr. Sondey joined TAL’s former parent, Transamerica Corporation, in April 1996 as Director of Corporate Development. He then joined TAL International Container Corporation in November 1998 as Senior Vice President of Business Development. In September 1999, Mr. Sondey became President of TAL International Container Corporation. Prior to his work with Transamerica Corporation and TAL International Container Corporation, Mr. Sondey worked as a Management Consultant at the Boston Consulting Group and as a Mergers & Acquisitions Associate at J.P. Morgan. Educational Background Mr. Sondey holds an MBA from The Stanford Graduate School of Business and a BA degree in Economics from Amherst College. Specific Qualifications, Attributes, Skills and Experience Mr. Sondey brings to the Board extensive industry, Company and operational experience from serving as our CEO, and prior to that from having served as the CEO of TAL. He has a breadth of experience managing a global business and in the areas of corporate finance and capital allocation, risk management, human capital management, strategic planning and mergers and acquisitions, as well as subject matter knowledge in the areas of logistics and international trade. As our CEO, he provides our Board with valuable perspectives regarding our business, strategy and performance and strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | |||

| |||||

Robert W. Alspaugh | has served as a director of the Company since July 2016 and is the Chair of the Audit Committee. Mr. Alspaugh also served as a director of TCIL from 2012 to 2016. Mr. Alspaugh had a 36-year career with KPMG LLP, including serving as Chief Executive Officer of KPMG International from 2002 to 2006. Prior to that, he served as Deputy Chairman and Chief Operating Officer of KPMG’s U.S. practice from 1998 to 2002 and, over the course of his career served as senior partner for a diverse array of global and domestic companies across a broad range of industries. Mr. Alspaugh currently serves on the board of directors of Veoneer, Inc. Mr. Alspaugh previously served on the board of directors of Autoliv, Inc., Ball Corporation and Verifone Systems, Inc. Educational Background Mr. Alspaugh received his B.B.A. degree in accounting from Baylor University, where he graduated summa cum laude. Specific Qualifications, Attributes, Skills and Experience Mr. Alspaugh brings to the Board knowledge and experience in a variety of areas, including extensive financial, accounting and auditing expertise, as well as a deep understanding of corporate finance, strategy, economics, international business and extensive public company board experience that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||||

| 2022 Proxy Statement | 15 | ||||

| |||||

Malcolm P. Baker | has served as a director since July Educational Background Mr. Baker holds a BA in applied mathematics and economics from Brown University, an M.Phil. in finance from Cambridge University, and a Ph.D in business economics from Harvard University. Specific Qualifications, Attributes, Skills and Experience Mr. Baker brings to the Board knowledge and experience in a variety of areas, including corporate finance, economics, capital markets and financial risk management both from an academic and finance industry perspective that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||||

| ||

Educational Background Ms. Bexiga received her B.S. degree with a concentration in Computer Science from Seton Hall University and an Executive MBA from Rutgers University, Singapore. Specific Qualifications, Attributes, Skills and Experience Ms. Bexiga brings to the Board knowledge and experience in a variety of areas, including information technology and financial services, and as a director of other U.S. and international public companies. Her extensive experience in information systems, cybersecurity, capital markets, risk management and corporate governance strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||

| 16 | TRITON | ||||

| |||||

Claude Germain | has served as a director since July 2016 and is the Chair of the Compensation and Talent Management Committee. Mr. Germain also served as a director of TAL from February 2009 to July 2016. Mr. Germain is the founder, Principal and Managing Partner of Rouge River Capital, an investment firm established in 2009 focused on acquiring controlling interests in a diversified portfolio of mid-market businesses spanning the trucking, manufacturing, dealership, real estate and leasing industries. From 2011 to 2013, Mr. Germain was also President and CEO of SMTC Corporation, a global manufacturer of electronics based in Canada and also served on its board of directors. From 2005 to 2010, Mr. Germain was Executive Vice President and Chief Operating Officer for Schenker of Canada Ltd., an affiliate of DB Schenker, one of the largest logistics service providers in the world. Prior to that, Mr. Germain was the President of a Texas-based third-party logistics firm and a management consultant specializing in distribution for The Boston Consulting Group. Mr. Germain serves on the boards of several private companies, as well as Canada Post Corporation. In 2002 and 2007, Mr. Germain was named Canadian Executive of the Year in Logistics. Educational Background Mr. Germain holds an MBA from Harvard Business School and a Bachelor of Engineering Physics (Nuclear) from Queen’s University. Specific Qualifications, Attributes, Skills and Experience Mr. Germain brings to the Board knowledge and experience in a variety of areas, including logistics, transportation, distribution, risk management and strategic planning and corporate governance that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||||

| ||

Kenneth Hanau Educational Background Mr. Hanau received his B.A. with honors from Amherst College and his M.B.A. from Harvard Business School. Specific Qualifications, Attributes, Skills and Experience Mr. Hanau brings to the Board knowledge and experience in a variety of areas, including corporate finance, capital markets, accounting, risk management and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||

| 2022 Proxy Statement | 17 | ||||

| |||

John S. Hextall Educational Background Mr. Hextall received a Bachelor of Science, Combined Honors Degree in Transport Planning & Operations, Urban Planning and Computer Science, at the Faculty of Engineering from Aston University in Birmingham, UK. Specific Qualifications, Attributes, Skills and Experience Mr. Hextall brings to the Board knowledge and experience in a variety of areas, including logistics, international transportation (sea and air freight), customs and compliance, distribution, risk management and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | |||

| ||

Educational Background Ms. Ramdev received her undergraduate degree from the University of Mumbai and an M.B.A. from Harvard Business School. Specific Qualifications, Attributes, Skills and Experience Ms. Ramdev brings to the Board knowledge and experience in a variety of areas, including finance, risk management, supply chain and international operations experience that strengthens the Board of Directors’ collective knowledge, capabilities and experience. | ||

| 18 | TRITON | ||||

| |||||

Robert L. Rosner | has served as a director since October 2015 | ||||

and is our Lead Independent Director | |||||

Educational Background Mr. Rosner received a B.A. in Economics from Trinity College and an M.B.A. with distinction from The Wharton School of the University of Pennsylvania. Specific Qualifications, Attributes, Skills and Experience Mr. Rosner brings to the Board knowledge and experience in a variety of areas, including international business, corporate finance, capital markets, strategic planning, risk management and corporate governance that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||

| ||

Simon R. Vernon has served as a director since July 2016. Upon the closing of the merger of TCIL and TAL in July 2016, Mr. Vernon, Educational Background Mr. Vernon holds a B.A. from Exeter University in England. Specific Qualifications, Attributes, Skills and Experience Mr. Vernon brings to the Board knowledge and experience in a variety of areas, including extensive industry knowledge as a former senior executive of our company and other leading container leasing companies, as well as logistics, human capital management, strategic planning, risk management and mergers and acquisitions experience that strengthens the Board of Directors’ collective knowledge, capabilities, and experience. | ||

Brian M. Sondey is our Chairman and Chief Executive Officer, and has served as a director of the Company since July 2016. Upon the closing of the Merger of Triton Container International Limited (“TCIL”) and TAL International Group, Inc. (“TAL”) in July 2016, Mr. Sondey, who had served as the Chairman, President and Chief Executive Officer of TAL since 2004, became the Chairman and Chief Executive Officer of Triton. Mr. Sondey joined TAL’s former parent, Transamerica Corporation, in April 1996 as Director of Corporate Development. He then joined TAL International Container Corporation in November 1998 as Senior Vice President of Business Development. In September 1999, Mr. Sondey became President of TAL International Container Corporation. Prior to his work with Transamerica Corporation and TAL International Container Corporation, Mr. Sondey worked as a Management Consultant at the Boston Consulting Group and as a Mergers & Acquisitions Associate at J.P. Morgan. Mr. Sondey holds an MBA from The Stanford Graduate School of Business and a BA degree in Economics from Amherst College.

As a result of these professional and other experiences, we believe Mr. Sondey possesses particular knowledge and experience in a variety of areas including corporate finance, intermodal equipment leasing, logistics, marketing, people management and strategic planning and strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Robert W. Alspaugh has served as a director of the Company since July 2016 and is the Chair of the Audit Committee. Mr. Alspaugh also has served as a director of TCIL since 2012. Mr. Alspaugh had a 36-year career with KPMG LLP, including serving as the senior partner for a diverse array of companies across a broad range of industries. Mr. Alspaugh has worked with global companies both in Europe and Japan, as well as with those headquartered in the United States. Between 2002 and 2006, when Mr. Alspaugh served as Chief Executive Officer

4

| 2022 Proxy Statement | 19 | ||||

additional, fresh perspectives contributed by newer directors. As a result, our Board has adopted a director term limit policy. Under this policy, directors (other than any management director) will be subject to a maximum term limit of Company. Self-Assessment Process effectiveness. Executive Sessions We have adopted a Code of Ethics which applies to all officers, directors and employees. Additionally, we have adopted a Code of Ethics for Chief Executive and Senior Financial Officers If we make any substantive amendment to, or grant a waiver from, a provision of the Code of Ethics or the Code of Ethics for Chief Executive and Senior Financial Officers We seek to provide our senior executives with compensation packages December 31, 2021. The Compensation Committee believes that competitive base salaries are necessary to attract and retain managerial talent. The Compensation Committee reviews and sets the salary levels for our NEOs annually. Base salaries are set at levels considered to be appropriate for the scope of the job function and the level of responsibility of the individual, the skills and qualifications of the individual, individual performance, the amount of time spent in the position, internal pay relationships and geographic circumstances. Base salaries are also evaluated relative to the amounts paid to executive officers with similar qualifications, experience and responsibilities at the peer group companies. 2020. company group in its reasonable discretion taking into account factors such as executive performance, tenure, market conditions, job responsibilities, experience, skill sets and actual or potential contributions to Triton. In addition, actual compensation earned in any year may be at, above, or below the median depending on the individual's and Triton's performance for the year.TABLEPROPOSAL 1 - ELECTION OF CONTENTSof KPMG International, he was responsible for implementing the strategy of KPMG International, which includes member firms in nearly 150 countries with more than 100,000 employees. Prior to this position, he served as Deputy Chairman and Chief Operating Officer of KPMG’s U.S. Practice from 1998 to 2002. Mr. Alspaugh currently serves on the boards of directors of Autoliv, Inc. (where he is the Chairman of the Audit Committee and a member of the Compliance Committee), Ball Corporation (where he is the Chairman of the Audit Committee and a member of the Finance Committee) and Verifone Systems, Inc. (where he is the Chairman of the Audit Committee and a member of the Governance and Nominating Committee). The Company's Board of Directors has determined that such simultaneous service by Mr. Alspaugh on the audit committees of three other public companies will not impair his ability to effectively serve on the Company's Audit Committee. Mr. Alspaugh received his B.B.A. degree in accounting from Baylor University, where he graduated summa cum laude.As a result of these professional and other experiences, we believe Mr. Alspaugh possesses particular knowledge and experience in a variety of areas including corporate finance, strategy, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.Malcolm P. Baker has served as a director of the Company since July 2016. Mr. Baker also served as a director of TAL from September 2006 to July 2016. Mr. Baker is the Robert G. Kirby Professor and the head of the finance unit of the Harvard University Graduate School of Business, the director of the corporate finance program at the National Bureau of Economic Research, and a consultant for Acadian Asset Management. Mr. Baker holds a BA in applied mathematics and economics from Brown University, an M.Phil. in finance from Cambridge University, and a Ph.D. in business economics from Harvard University.As a result of these professional and other experiences, we believe Mr. Baker possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.David A. Coulter has served as a director of the Company since October 2015. Currently, Mr. Coulter serves as Special Limited Partner at Warburg Pincus, LLC and has served as Vice Chairman, Managing Director and Senior Advisor at Warburg Pincus, focusing on the firm’s financial services practice, from 2005 - 2014. Mr. Coulter retired in September 2005 as Vice Chairman of J.P. Morgan & Chase Co. He previously served as Executive Chairman of its investment bank, asset and wealth management, and private equity business. Mr. Coulter was a member of the firm’s three person Office of the Chairman and also its Executive Committee. Mr. Coulter came to J.P. Morgan Chase via its July 2000 acquisition of The Beacon Group, a small merchant banking operation. Before joining The Beacon Group, Mr. Coulter was the Chairman and Chief Executive Officer of the BankAmerica Corporation and Bank of America NT & SA. His career at Bank of America was from 1976 to 1998 and covered a wide range of banking activities. He served on the board of Aeolus Re, MBIA, Webster Bank, Sterling Financial and the Strayer Corporation. He currently is on the board of Varo Money, Inc, where he serves on their Compensation and Audit & Risk committees and Providence Services Corporation, where he serves on their Compensation and Nominating & Corporate Governance committees. He also serves on the boards of American Prairie Reserve, Third Way, Macaulay Honors College, IQ2, Carnegie Mellon University, and Asia Society of Northern California. He received both his B.S. and his M.S. from Carnegie Mellon University and currently serves as a Trustee for Carnegie Mellon.As a result of these professional and other experiences, we believe Mr. Coulter possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.Claude Germain has served as a director of the Company since July 2016 and is the Chair of the Compensation Committee. Mr. Germain also served as a director of TAL from February 2009 to July 2016. Since 2010, Mr. Germain has been a principal in Rouge River Capital, an investment firm focused on acquiring controlling stakes in private midmarket transportation and manufacturing companies. From 2011 to 2013, Mr. Germain was also President and CEO of SMTC Corporation (Nasdaq: SMTX), a global manufacturer of electronics based in Markham, Ontario. From 2005 to 2010, Mr. Germain was Executive Vice President and Chief Operating Officer for Schenker of Canada Ltd., an affiliate of DB Schenker, where he was accountable for Schenker’s Canadian business. DB Schenker is one of the largest logistics service providers in the world. Prior to that, Mr. Germain was the President of a Texas-based third-party logistics firm and a management consultant specializing in distribution for The Boston Consulting Group. In 2002 and 2007, Mr. Germain won Canadian Executive of the Year in Logistics. Mr. Germain holds an MBA from Harvard Business School and a Bachelor of Engineering Physics (Nuclear) from Queen’s University.DIRECTORSBoard Refreshment, Director Selection and Nomination Process5As a result of these professional and other experiences, we believe Mr. Germain possesses particular knowledge and experience in a variety of areas including logistics, transportation, distribution, and strategic planning that strengthens theThe Board, of Directors’ collective knowledge, capabilities, and experience.Kenneth Hanau has been a director of the Company since July 2016. Mr. Hanau also served as a director of TAL from October 2012 to July 2016. Mr. Hanau is a Managing Director at Bain Capital Private Equity, a unit of Bain Capital, one of the world’s foremost private investment firms with approximately $75 billion in assets under management. He has significant experience in private equity investing, with specialized focus in the industrial and business services sectors, and currently leads Bain Capital Private Equity’s North American industrials team. Prior to joining Bain Capital in 2015, Mr. Hanau was the Managing Partner of 3i’s private equity business in North America. Mr. Hanau played an active role in investments in the industrial and business services sectors, including Mold Masters, a leading supplier of specialty components to the plastic industry, and Hilite, a global manufacturer of automotive solutions. Previously, Mr. Hanau held senior positions with Weiss, Peck & Greer and Halyard Capital. Before that, Mr. Hanau worked in investment banking at Morgan Stanley and at K&H Corrugated Case Corporation, a family-owned packaging business. Mr. Hanau is a certified public accountant and started his career with Coopers & Lybrand. Mr. Hanau received his B.A. with honors from Amherst College and his M.B.A. from Harvard Business School.As a result of these professional and other experiences, we believe Mr. Hanau possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.John S. Hextall has been a director of the Company since July 2016. In October 2016, he joined the Board of Directors of Pacific National in Australia as a nominee on behalf of investors Canada Pension Plan Investment Board (“CPPIB”). He joined Shanghai based De Well Group, a privately held logistics company, at its office located in Bell, CA as Chief Executive Officer and Board member in October 2016. In March 2016, he became President and founder of Steers, Inc., a strategy and management consulting firm. From 2010 to 2016, Mr. Hextall served as President and CEO of the North American Region of Kuehne + Nagel, Inc. (SIX Swiss: KNIN), a leading global transportation and logistics provider, based in Jersey City, NJ, responsible for its subsidiaries in Canada, Mexico and the United States. He also served as CEO of Nacora Insurance Brokers Inc. Prior to his role at Kuehne + Nagel, Inc., Mr. Hextall had a wide-ranging career at UTi Worldwide Inc. (“UTi”) (Nasdaq: UTIW), a supply chain management company and was a member of the founding management team, serving as a Member of UTi's Executive Management Board from 2005 to 2009. Mr. Hextall held various positions at UTi over the course of 17 years, including Executive Vice President and President of Freight Forwarding from 2008 to 2010, Executive Vice President and Chief Operating Officer from 2007 to 2008 and Executive Vice President and Global Leader of Client Solutions & Delivery from 2006 to 2007. Other roles included leadership in Europe, the UK and Belgium. Prior to his career with UTi, Mr. Hextall worked at BAX Global (formerly Burlington Air Express), where he served as a UK director. Mr. Hextall previously worked at the Booker Group and was a management graduate with Unilever. Since 1980, Mr. Hextall has been a member of the Chartered Institute of Logistics and Transport, and has served as a Roundtable Member of the Council for Supply Chain Management Professionals and The Conference Board’s Global Council for Supply Chain & Logistics based in Brussels. In 1979, Mr. Hextall received a Bachelor of Science, Combined Honors Degree in Transport Planning & Operations, Urban Planning and Computer Science, at the Faculty of Engineering from Aston University in Birmingham, UK.As a result of these professional and other experiences, we believe Mr. Hextall possesses particular knowledge and experience in a variety of areas including logistics, transportation, distribution, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.Robert L. Rosner is a Founding Partner and Co-President of Vestar Capital Partners, Inc. Mr. Rosner has served as a director of the Company since October 2015 and is Lead Director and the Chair ofled by the Nominating and Corporate Governance Committee. He previously served as a memberCommittee, regularly evaluates its own composition and succession plans in light of the TCILCompany’s evolving business and strategic needs. The focus of this process is to ensure that the Board is comprised of directors who possess an appropriate balance of tenure, relevant skills, professional experiences and backgrounds and diverse viewpoints and perspectives in order to effectively oversee the Company’s operations and strategy. This includes diversity of gender, race, ethnicity, age, geography, sexual orientation and gender identity. To promote thoughtful Board refreshment, we have:•established a process for ongoing Board succession planning and assessing director candidates which incorporates a focus on Board diversity;•utilized our annual Board and Committee assessment process to solicit feedback on Board and Committee size and structure; and•adopted term limits for non-management directors.The current Board composition reflects the Board’s commitment to ongoing refreshment, with two new directors having joined the Board since 2013the beginning of 2020. The average age of our director nominees is 59.4 years, and asthe average tenure of our director nominees is 5.2 years. Board Candidate Evaluation and Succession Planning ConsiderationsWhen evaluating a memberdirector candidate, the Nominating and Corporate Governance Committee considers factors that are in the best interests of Triton and its Compensation Committee. He has been with Vestar Capital Partners, Inc. since shareholders, including:•personal qualities of leadership, integrity and judgment of each candidate;•the firm’s formation in 1988. Mr. Rosner also heads Vestar Capital Partners’ Business Servicesprofessional experience of the candidate and Industrial Products Groups. In 2000, Mr. Rosner moved to Paris to establish Vestar Capital Partners’ operations in Europe and served as President of Vestar Capital Partners Europe from 2000 - 2011, overseeing the firm’s affiliate offices in Paris, Milan and Munich. Priortheir potential contributions to the formationdiversity of Vestar Capital Partners, Mr. Rosner wasknowledge, backgrounds, experience and competencies of our Board and its committees, including those key skills discussed under Director Skills and Qualifications;•each candidate’s ability to devote sufficient time and effort to fulfill a memberdirector’s duties to the Company, given the candidate’s other commitments;•whether the individual meets applicable independence requirements and is free of conflicts of interest; and•other relevant factors as may be considered by our Board from time to time.In that regard, the Board may identify certain skills, experiences or attributes as being particularly desirable to help meet specific Board needs that have arisen or are expected to arise. When the Nominating and Corporate Governance Committee reviews a potential new candidate, it looks specifically at the candidate's qualifications in light of these needs as well as the qualifications for Board membership described above. Additionally, the Nominating and Corporate Governance Committee annually reviews the tenure, skills and contributions of existing Board members to the extent they are candidates for reelection.In connection with the director nomination process, the Nominating and Corporate Governance Committee may identify candidates through recommendations provided by members of the Management Buyout Group at The First Boston Corporation. He isBoard, management, shareholders or other persons, and has also engaged professional search firms to assist in identifying or evaluating qualified candidates. Ms. Ramdev, who was appointed to the Board in 2021, was identified through a director of Edward Don & Company and Mobile Technologies Inc. Mr. Rosner previously served as a director of Institutional Shareholder Services Inc., Group OGF, Seves S.p.A., Sunrise Medicalsearch firm.The Board seeks and values diversitySince the beginning of 2020, the Board has added two new diverse female directors. In each of those searches, the Nominating and Corporate Governance Committee prioritized increasing gender and/or racial and ethnic diversity on the Board, among other relevant qualifications. The Board’s commitment to diversity is ongoing. When conducting searches for new directors, the Nominating and Corporate Governance Committee intends to continue to take steps to include a diverse slate of candidates in the pool from which director candidates are chosen (sometimes referred to as the “Rooney Rule”).620 TRITON PROPOSAL 1 - ELECTION OF DIRECTORSInc., Tervita CorporationBoard Tenure and 21st Century Oncology, Inc. Mr. Rosner is a memberTerm Limit PolicyThe Board recognizes the importance of the Graduate Executive Boardmaintaining an appropriate balance of The Wharton School of the University of Pennsylvania and previously servedtenure on the Board which allows it to benefit from both the historical and institutional knowledge of Trustees of The Lawrenceville School. He received a B.A. in Economics from Trinity College and an M.B.A. with distinction from The Wharton School oflonger-tenured directors as well as the University of Pennsylvania.these professional12 years, unless an exemption is granted by the Board. The current average tenure of our directors is approximately 5.2 years.Director Overboarding PolicyTo help ensure that all of our directors have sufficient time to fulfill their duties to the Company, our Corporate Governance Principles and Guidelines provide that a director who serves as CEO, CFO or other experiences, we believe Mr. Rosner possesses particular knowledgenamed executive officer at another public company should not serve on more than two public company boards, including our Board. Other directors should not serve on more than four public company boards, including our Board.Shareholder Candidate Recommendations and experienceNominations ProcessThe Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders and evaluate them using the same criteria as for other candidates. The Nominating and Corporate Governance Committee may conduct such inquiry into each candidate’s background, qualifications and independence as it believes is necessary or appropriate under the circumstances and regardless of whether the candidate was recommended by shareholders or by others.Any nominations of director candidates by shareholders pursuant to the advance notice provisions of our Bye-Laws should be submitted to the Nominating and Corporate Governance Committee, Triton International Limited, Victoria Place, 5th Floor, 31 Victoria Street, Hamilton HM 10, Bermuda not before December 28, 2022 and not later than January 27, 2023 for the 2023 Annual General Meeting and should otherwise comply with the requirements for shareholder director nominations in our Bye-Laws. Submission must include the full name, age, business address and residence and must include all information required by the proxy rules, applicable law and our Bye-Laws. If a varietyshareholder submits a director candidate in accordance with the requirements specified in our Bye-Laws, the Nominating and Corporate Governance Committee will consider such director candidate using the same standards it applies to evaluate other director candidates.2022 Proxy Statement 21 Corporate GovernanceCorporate Governance FrameworkTriton has a long-standing commitment to strong corporate governance, management accountability and ethical standards which promotes the long-term interests of areas including corporate finance, capital markets, and strategic planning that strengthensshareholders. Evidencing this commitment, the Board has adopted the Triton Corporate Governance Principles and Guidelines, Code of Directors’ collective knowledge, capabilities,Ethics and experience.Simon R. Vernon has servedCode of Ethics for Chief Executive and Senior Financial Officers, as a directorwell as charters for each of the Company since July 2016. UponBoard’s committees. These documents constitute the closingfoundation of the Merger of TCILour corporate governance structure and TAL in July 2016, Mr. Vernon, who had served as the President and Chief Executive Officer of TCIL since 2003, became the President of Triton, a position which he held until he retiredare available on February 28, 2018. Before being named President and Chief Executive Officer of TCIL, Mr. Vernon served as Executive Vice President of TCIL beginning in 1999, Senior Vice President beginning in 1996 and Vice President of Global Marketing beginning in 1994. Mr. Vernon also served as Director of Marketing of TCIL beginning in 1986, responsible for Southeast Asia and China and, beginning in 1991, for all of the Pacific basin. He was named Vice President, Marketing, responsible for the Pacific basin, in 1993. Prior to joining TCIL, Mr. Vernon served as chartering manager at Jardine Shipping Limited from 1984 to 1985, as a managerour website (www.trtn.com) in the owner’s brokering department at Yamamizu Shipping Company Limited from 1982 to 1984Investors section under “Corporate Governance.” The Board regularly reviews our policies and asprocesses in the context of current corporate governance trends, regulatory changes and recognized best practices.Highlights of our corporate governance practices include:![]() SHAREHOLDERRIGHTS

SHAREHOLDERRIGHTS![]() BOARDOVERSIGHT

BOARDOVERSIGHT![]() BOARD COMPOSITIONAND INDEPENDENCE•Annual Election of Directors•Majority Voting for Directors•No Poison Pill•Right to Call Special Meeting•One Class of Common Shares With Each Share Entitled to One Vote•Active Strategy and Risk Oversight by Full Board and Committees, including:•Business and Market Risks•COVID-19 Response•ESG Initiatives•Human Capital Management•Robust Shareholder Engagement•Lead Independent Director•80% Independent Board and Fully Independent Board Committees•Board Commitment to Recruiting Qualified, Diverse Director Candidates•12-Year Term Limit for Non-Management Directors

BOARD COMPOSITIONAND INDEPENDENCE•Annual Election of Directors•Majority Voting for Directors•No Poison Pill•Right to Call Special Meeting•One Class of Common Shares With Each Share Entitled to One Vote•Active Strategy and Risk Oversight by Full Board and Committees, including:•Business and Market Risks•COVID-19 Response•ESG Initiatives•Human Capital Management•Robust Shareholder Engagement•Lead Independent Director•80% Independent Board and Fully Independent Board Committees•Board Commitment to Recruiting Qualified, Diverse Director Candidates•12-Year Term Limit for Non-Management Directors![]() EXECUTIVECOMPENSATIONAND SHAREHOLDERALIGNMENT

EXECUTIVECOMPENSATIONAND SHAREHOLDERALIGNMENT![]() OTHER GOVERNANCEPRACTICES•Annual “Say on Pay” Advisory Vote•Annual Benchmarking of Executive Compensation and Company Performance Against Relevant Peer Group•Anti-Hedging/Anti-Pledging Policies for Directors, Officers and Employees•Clawback Policy for Equity Awards and Annual Incentive Compensation•Meaningful Share Ownership Requirements for Executive Officers and Directors•Active Board Role in CEO and Management Succession Planning•Regular Executive Sessions of Non-management and Independent Directors•Director Overboarding Limits•Annual Board and Committee Self-Assessments